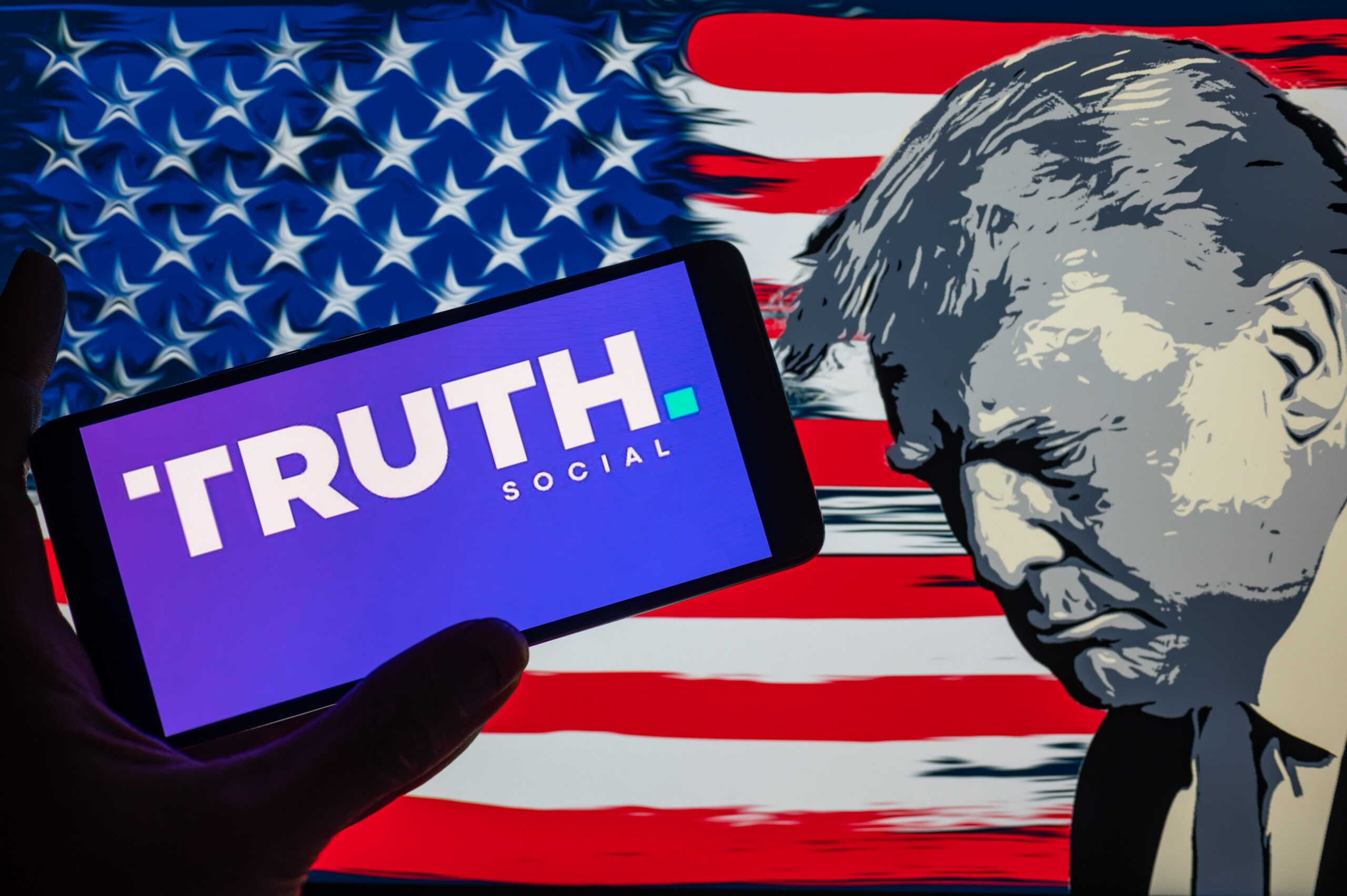

Trump Media & Technology Group, the company behind Truth Social, the social media platform associated with President-elect Donald Trump, appears to be broadening its ambitions into the cryptocurrency space. This week, the organization filed a trademark application for a service named “TruthFi,” described as a cryptocurrency payment processing platform, marking a potential new chapter for the media firm.

The trademark application outlines various potential uses for TruthFi, including card payment processing, asset management, custody services, and the trading of digital assets. However, the application itself provides limited detail, leaving the scope and depth of Trump Media’s intentions unclear.

Observers are questioning whether TruthFi represents an imminent launch or is simply an exploratory step in a rapidly evolving industry. The filing adds fuel to speculation about Trump Media’s plans to diversify beyond its existing operations in social media, possibly leveraging the burgeoning interest in cryptocurrency to bolster its portfolio.

Efforts to obtain a comment from Trump Media about this potential venture were met with silence, leaving analysts and the public to interpret the implications of this move independently.

The trademark filing also highlights the broader ethical questions surrounding Donald Trump’s dual roles as both a businessman and the incoming president of the United States. Critics have pointed to the significant conflicts of interest that arise when Trump’s private ventures intersect with public policy decisions. These concerns are amplified in light of his administration’s forthcoming influence on federal cryptocurrency regulations.

Richard Painter, former chief ethics lawyer during the George W. Bush administration and now a law professor at the University of Minnesota, noted that the situation reflects systemic ethical challenges. “It’s not unique to Trump, but it’s a glaring issue,” Painter said. “Just as Congress members trade cryptocurrencies while delaying regulation, we now face a situation where a sitting president could have a vested interest in crypto-related decisions.”

Painter stressed the importance of Trump divesting from his business holdings to avoid conflicts of interest, particularly regarding ventures like Truth Social and any cryptocurrency initiatives. “Every other president has taken steps to eliminate such conflicts. Trump should do the same with his personal and organizational assets,” Painter added.

Trump’s exploration of the crypto space is unfolding in the context of his growing alignment with the cryptocurrency industry. During his campaign, Trump pledged to transform the United States into the “crypto capital of the planet” and proposed creating a national cryptocurrency reserve. These commitments, alongside his apparent shift from skepticism to advocacy for bitcoin and other digital currencies, have resonated with a crypto community eager for regulatory reform.

The timing of the trademark filing is notable. Just weeks after his election victory, Trump has already signaled a shift in the regulatory landscape. He has promised to appoint crypto-friendly officials, beginning with a replacement for SEC Chairman Gary Gensler, a figure viewed as a key adversary by many in the crypto industry. Gensler announced his resignation would coincide with Trump’s inauguration, heightening anticipation for a significant regulatory pivot.

Adding to the intrigue, Trump Media is reportedly in advanced talks to acquire Bakkt, a prominent crypto trading platform. While the news remains unconfirmed, reports of the negotiations caused Bakkt’s stock to surge by over 160% this week. A spokesperson for Bakkt declined to comment on what it described as “market rumors or speculation.”

Trump Media’s burgeoning interest in cryptocurrency also includes a newly launched venture, World Liberty Financial, and a potential partnership with influential industry players. Earlier this week, Trump appointed Howard Lutnick, CEO of Cantor Fitzgerald and a vocal supporter of cryptocurrency firm Tether, to lead the Department of Commerce.

As January approaches, Trump’s administration is poised to make critical decisions that could reshape the crypto landscape, with potential benefits not only for the industry but also for Trump’s personal and professional interests. Whether these moves represent a strategic vision or opportunistic alignment remains to be seen, but they undoubtedly signal a new phase of engagement between Washington and the world of cryptocurrency.